Sustainable Finance

- Sustainability-Linked Medium Term Note Framework

- Sustainability-Linked Financing Framework

Sustainability-Linked Medium Term Note Framework

In 2021, Sunway REIT became the first Malaysian Real Estate Investment Trust to integrate sustainability considerations into its capital management strategy through the issuance of Malaysia’s first-ever Sustainability-Linked Medium Term Note (SLMTN) under SUNREIT Bond Berhad (formerly known as SUNREIT Unrated Bond Berhad).

The SLMTN framework, which governs the terms of the SLMTN, is viewed to have an Aligned to Strong level of disclosure by RAM Sustainability Sdn Bhd on 17 May 2024. Click here to view the Second Opinion Report.

KEY FEATURES OF SLMTN FRAMEWORK

Key Performance Indicators (KPIs)

The Manager has selected the following KPIs which are direct, relevant and material with regards to the core business of Sunway REIT and coherent with its environmental, social and governance (ESG) strategy and priorities as well as meaningful in terms of measuring Sunway REIT’s ESG performance:

KPI-1:

Annual Renewable Energy Generation (MWh)

KPI-2:

Building Energy Intensity (kWh/m2/ year)

“Annual Renewable Energy Generation” shall mean the aggregate units of electrical energy in megawatt-hours (MWh) generated by solar photovoltaic energy generation facilities located on or within the properties in Sunway REIT as detailed below:

- Sunway Pyramid Mall

- Sunway Carnival Mall

- SunCity Ipoh Hypermarket

- Sunway Putra Mall

- Sunway Pier

- Menara Sunway

- Sunway Tower

- Sunway Putra Tower

- Wisma Sunway

- Sunway Pinnacle

- Sunway Resort Hotel

- Sunway Pyramid Hotel

- Sunway Lagoon Hotel

- Sunway Putra Hotel

- Sunway Hotel Seberang Jaya

- Sunway Hotel Georgetown

- Sunway university & college campus

- Sunway REIT Industrial – Shah Alam 1

- Sunway REIT Industrial – Petaling Jaya 1

- Future properties to be acquired by Sunway REIT

“Building Energy Intensity (BEI)” is as defined by the Green Building Index Malaysia and measured in (kWh/m2/year). The KPI shall be calculated for the following identified properties in Sunway REIT (which contribute to bulk of the electricity usage of Sunway REIT) as detailed below:

- Sunway Pyramid Mall

- Sunway Carnival Mall

- Sunway Putra Mall

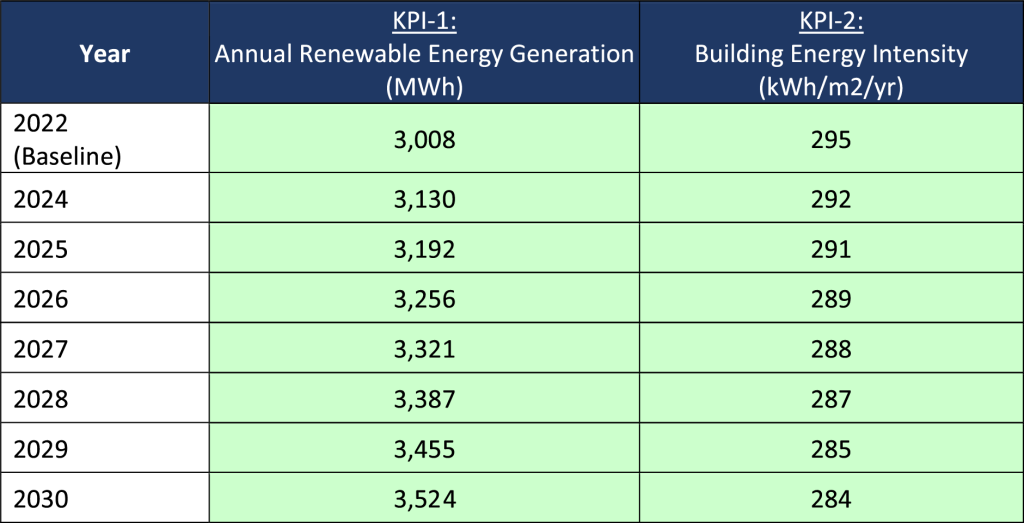

Sustainability Performance Targets (SPTs)

The Manager has set the following SPTs in relation to the selected KPIs which reflect Sunway REIT’s commitment to its medium-term ESG goals.

Bond Characteristics

The achievement or non-achievement of the SPT will result in a change to the SLMTNs characteristics (sustainability adjustment) which could include one or combination of the following:

(1) Coupon rate or credit margin adjustment

A Step-down or Step-up shall be applied on the original coupon rate (for fixed rate SLMTNs) or credit margin (for floating rate SLMTNs). The coupon rate or credit margin shall be reduced / Step-down or increased / Step-up, by a pre-determined quantum denoted in basis points (bps) until the maturity of the SLMTNs (with reference to the achievement of the SPTs as disclosed in Sunway REIT’s Annual Sustainability Report).

Notes:-

- (-) denotes a Step-down from the original coupon rate or credit margin, whereas (+) denotes a Step-up from the original coupon rate or credit margin;

- For avoidance of doubt, the Issuer may opt for either Step-down or Step-up, or combination of both, as documented in the relevant issuance documentation for that SLMTNs;

- The quantum of the Step-down or Step-up shall be denoted in basis points (bps) to be determined prior to each issuance of the SLMTNs and documented in the subscription agreement or relevant issuance documentation for that SLMTNs;

- One adjustment shall be applicable for each financial year and the adjustments will be cumulative if the SLMTNs exceeds 1 year; and

- The adjustment shall take effect for that financial year from the first day of the next coupon period following completion of an annual assessment of the relevant financial year until the next assessment / maturity date of the SLMTNs, whichever is earlier.

(2) Purchase of renewable energy

The Issuer shall be required to purchase a pre-determined amount of renewable energy equivalent a percentage (%) of the amount of the SLMTNs issued, based on the net point achieved (with reference to the achievement of the SPTs as disclosed in Sunway REIT’s Annual Sustainability Report).

Notes:

- (+) denotes a plus point if the KPI is met and (-) denotes a minus point if the KPI is not met;

- The Issuer shall only be required to purchase renewable energy in the event that the net point achieved is (-). For avoidance of doubt, if one KPI is met and another KPI is not met for a financial year, the Issuer shall not be required to purchase renewable energy for that financial year.

- The amount of renewable energy to be purchased shall be equivalent to a percentage (%) of the amount of the SLMTNs issued to be determined prior to each issuance of the SLMTNs and documented in the subscription agreement or relevant issuance documentation for that SLMTNs;

- One adjustment shall be applicable for each financial year and the adjustments will be cumulative if the SLMTNs exceeds 1 year; and

- If purchase of renewable energy is not available due to force majeure events such as changes in regulations, the Issuer and the respective subscriber(s) of the SLMTNs shall agree on another method of adjustment.

(3) Any other arrangement as agreed between the Issuer and the respective subscriber(s) of the SLMTNs which may include, but not limited, to the following:

- Redemption price adjustment

- Purchase of carbon credits

- Payment for green certification of properties under Sunway REIT

If the Issuer fails to deliver a third-party independent assurance statement, both KPIs shall be deemed to have not been met and relevant adjustment shall apply for that financial year.

Reporting

The Manager will make relevant disclosure with regards to the achievement of the KPIs in the Annual Sustainability Report of Sunway REIT on an annual basis.

Such disclosure may include the following information:

- Up-to-date information which the Manager considers relevant on the performance of the selected KPIs, including but not limited to Sunway REIT’s ESG governance as well as sustainability strategy and related KPIs; and

- Independent assurance statement on the Annual Sustainability Report of Sunway REIT.

Verification

Pre-issuance, the Issuer has engaged Malaysian Rating Corporation Berhad (MARC) to review its initial Framework and provide a Second-Party Opinion of the initial Framework with respect to the alignment of the Framework and associated documentation with the ICMA Sustainability-Linked Bond Principles. MARC has accorded a Silver Impact Bond Assessment pursuant to its review of the initial Framework on 2 December 2021. Subsequently, the Issuer has engaged RAM Sustainability Sdn Bhd (RAM Sustainability) to review its revised Framework. On 17 May 2024, RAM Sustainability issued its Second Opinion Report which concluded that the revised Framework to be in line with the ICMA Sustainability-Linked Bond Principles and ACMF ASEAN Sustainability-Linked Bond Standards. The revised Framework is viewed to have an Aligned to Strong level of disclosure.

Post-issuance, achievement of the KPIs shall be verified by an independent third-party auditor and/or adviser and disclosed by Sunway REIT as part of its Annual Sustainability Report on an annual basis, and where required, until after the last SPT trigger event of the SLMTNs has been reached.

SUSTAINABILITY-LINKED FINANCING FRAMEWORK

Pursuant to Sunway REIT’s overarching focus towards achieving its sustainability goals and time-based commitments, Sunway REIT has made extensive inroads towards its maiden venture in sustainable finance, in the form of Sustainability-Linked Medium Term Notes (SLMTNs) in accordance with its SLMTN Framework published in 2021 and enhanced in 2023.

This Sustainability-Linked Financing Framework (Framework) issued on 1 August 2024 incorporates and expands upon the scope of SLMTN Framework. The enlarged scope of application includes:

- The Framework applies to Sunway REIT and its subsidiaries, including but not limited to SUNREIT Bond Berhad, SUNREIT Perpetual Bond Berhad, SUNREIT Capital Berhad and any future Special Purpose Vehicle (SPV) established by Sunway REIT for financing purposes (collectively known as “Issuer”).

- The Framework encompasses all Sustainability-Linked Financing (SLF) utilised by Sunway REIT and its subsidiaries, including but not limited to medium-term notes, perpetual notes, commercial papers, revolving loans, revolving credit facilities, swaps and any other available financial instruments with Sustainability-Linked features.

On 23 August 2024, RAM Sustainability issued its Second Opinion Report which concluded that the Framework is in line with the Sustainability-Linked Principles. The Framework is assigned a Gold Sustainable Finance Rating and is viewed to have an Aligned level of disclosure. Click here to view the Second Opinion Report.

KEY FEATURES OF SLF FRAMEWORK

Key Performance Indicators (KPIs)

The Manager has selected the following KPIs which are direct, relevant and material with regards to the core business of Sunway REIT and coherent with its environmental, social and governance (ESG) strategy and priorities as well as meaningful in terms of measuring Sunway REIT’s ESG performance:

KPI-1:

Annual Renewable Energy Generation (MWh)

KPI-2:

Building Energy Intensity (kWh/m2/ year)

“Annual Renewable Energy Generation” shall mean the aggregate units of electrical energy in megawatt-hours (MWh) generated by solar photovoltaic energy generation facilities located on or within the properties in Sunway REIT as detailed below:

- Sunway Pyramid Mall

- Sunway Carnival Mall

- SunCity Ipoh Hypermarket

- Sunway Putra Mall

- Sunway Pier

- Menara Sunway

- Sunway Tower

- Sunway Putra Tower

- Wisma Sunway

- Sunway Pinnacle

- Sunway Resort Hotel

- Sunway Pyramid Hotel

- Sunway Lagoon Hotel

- Sunway Putra Hotel

- Sunway Hotel Seberang Jaya

- Sunway Hotel Georgetown

- Sunway university & college campus

- Sunway REIT Industrial – Shah Alam 1

- Sunway REIT Industrial – Petaling Jaya 1

- Future properties to be acquired by Sunway REIT

“Building Energy Intensity (BEI)” is as defined by the Green Building Index Malaysia and measured in (kWh/m2/year). The KPI shall be calculated for the following identified properties in Sunway REIT (which contribute to bulk of the electricity usage of Sunway REIT) as detailed below:

- Sunway Pyramid Mall

- Sunway Carnival Mall

- Sunway Putra Mall

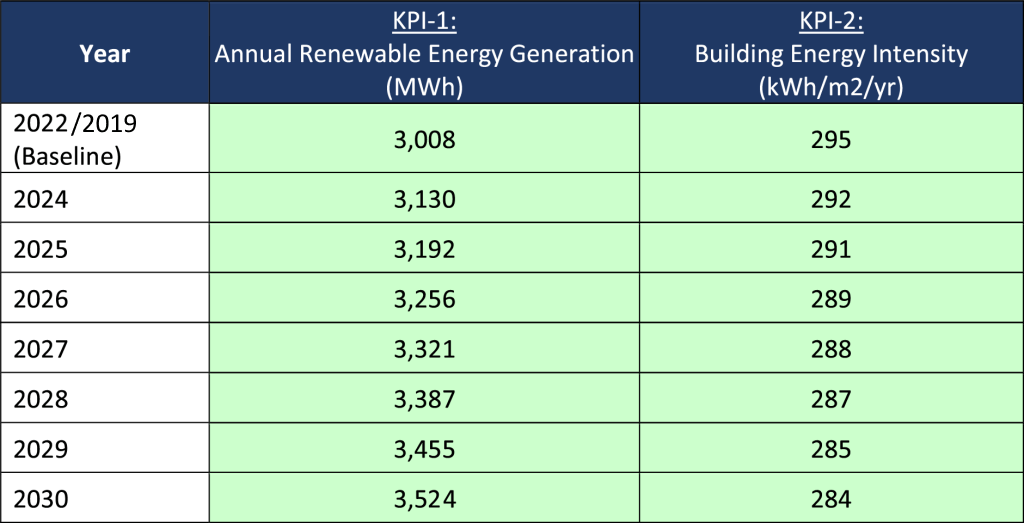

Sustainability Performance Targets (SPTs)

The Manager has set the following SPTs in relation to the selected KPIs which reflect Sunway REIT’s commitment to its medium-term ESG goals.

Bond Characteristics

The achievement or non-achievement of the SPT will result in a change to the SLF characteristics (sustainability adjustment) which could include one or combination of the following:

(1) Coupon rate or credit margin adjustment

A Step-down or Step-up shall be applied on the original coupon rate (for fixed rate SLF) or credit margin (for floating rate SLF). The coupon rate or credit margin shall be reduced / Step-down or increased / Step-up, by a pre-determined quantum denoted in basis points (bps) until the maturity of the SLF (with reference to the achievement of the SPTs as disclosed in Sunway REIT’s Annual Sustainability Report).

Notes:

- (-) denotes a Step-down from the original coupon rate or credit margin, whereas (+) denotes a Step-up from the original coupon rate or credit margin;

- For avoidance of doubt, the Issuer may opt for either Step-down or Step-up, or combination of both, as documented in the relevant issuance documentation for that SLF;

- The quantum of the Step-down or Step-up shall be denoted in basis points (bps) to be determined prior to each issuance of the SLF and documented in the subscription agreement or relevant issuance documentation for that SLF;

- One adjustment shall be applicable for each financial year and the adjustments will be cumulative if the SLF exceeds 1 year; and

- The adjustment shall take effect for that financial year from the first day of the next coupon period following completion of an annual assessment of the relevant financial year until the next assessment / maturity date of the SLF, whichever is earlier.

(2) Purchase of renewable energy

The Issuer shall be required to purchase a pre-determined amount of renewable energy equivalent a percentage (%) of the amount of the SLF issued, based on the net point achieved (with reference to the achievement of the SPTs as disclosed in Sunway REIT’s Annual Sustainability Report).

Notes:

- (+) denotes a plus point if the KPI is met and (-) denotes a minus point if the KPI is not met;

- The Issuer shall only be required to purchase renewable energy in the event that the net point achieved is (-). For avoidance of doubt, if one KPI is met and another KPI is not met for a financial year, the Issuer shall not be required to purchase renewable energy for that financial year.

- The amount of renewable energy to be purchased shall be equivalent to a percentage (%) of the amount of the SLF issued to be determined prior to each issuance of the SLF and documented in the subscription agreement or relevant issuance documentation for that SLF;

- One adjustment shall be applicable for each financial year and the adjustments will be cumulative if the SLF exceeds 1 year; and

- If purchase of renewable energy is not available due to force majeure events such as changes in regulations, the Issuer and the respective subscriber(s) of the SLF shall agree on another method of adjustment.

(3) Any other arrangement as agreed between the Issuer and the respective subscriber(s) of the SLF which may include, but not limited, to the following:

- Redemption price adjustment

- Purchase of carbon credits

- Payment for green certification of properties under Sunway REIT

If the Issuer fails to deliver a third-party independent assurance statement, both KPIs shall be deemed to have not been met and relevant adjustment shall apply for that financial year.

Reporting

The Manager will make relevant disclosure with regards to the achievement of the KPIs in the Annual Sustainability Report of Sunway REIT on an annual basis.

Such disclosure may include the following information:

- Up-to-date information which the Manager considers relevant on the performance of the selected KPIs, including but not limited to Sunway REIT’s ESG governance as well as sustainability strategy and related KPIs; and

- Independent assurance statement on the Annual Sustainability Report of Sunway REIT.

Verification

Pre-issuance, the Issuer engaged RAM Sustainability Sdn Bhd (RAM Sustainability) to review the Framework. On 23 August 2024, RAM Sustainability issued its Second Opinion Report which concluded that the Framework is in line with the Sustainability-Linked Principles. The Framework is assigned a Gold Sustainable Finance Rating and is viewed to have an Aligned level of disclosure.

Post-issuance, achievement of the KPIs shall be verified by an independent third-party auditor and/or adviser and disclosed by Sunway REIT as part of its Annual Sustainability Report on an annual basis, and where required, until after the last SPT trigger event of the SLF has been reached.

Partnership to Develop Joint Training Programmes

- We offer tuition fee discounts for staff who wish to pursue their post-graduate / professional certification such as the Coding Bootcamp with 42KL.

- We will also collaborate with Sunway iLabs to deliver a Design Thinking Workshop for staff.

Formal talent pipeline development strategy

We provide training to all employees, including full-time workers, part-time workers, contractors, and temporary workers.

We review our talents annually and conduct discussions on succession planning for key positions.

We conduct leadership programmes such as Excellence in My Career and Leadership (ExCel@Sunway).